ISSUE 02, VOL. 01

June 2013

Dear Colleagues:

Happy June! The recent Memorial Day holiday gave us a chance to recognize and honor those who gave their lives in service to the USA. We extend our deep thanks to all of our veterans and active service members and their families. Now, we introduce our 2nd issue of TAG Lines - please enjoy!

EXW or CIP?

Is your company among the roughly 95% of U.S. exporters that apply "Ex-Works" or "EXW" to your shipments? Can you provide proof of export / proof of delivery? If not, you may be unable to get paid in a claim situation under your credit insurance policy. What's more, you may be leaving yourself open to fines and penalties for non-compliance with U.S. export regulations. Consider your INCOTERMS carefully... they impact your costs, your risks, your insurance coverage and your compliance with export regulations!

• INCOTERMS are published by the International Chamber of Commerce (ICC) - see the ICC website as a resource for related information.

• More information on the U.S. Export Administration Regulations (EAR) can be found here.

Logistics can be complex. We strongly advise that you engage the expertise and services of a seasoned international freight forwarder who works in your best interest - not your foreign buyer's - to help you manage your shipments and related documentation. In the Midwest and Chicagoland area, we recommend LR International (LRI). LRI received the  President's "E" Award for Export Service in 2012 and the company's wide reach includes 12 offices throughout North America and locations in 102 countries. This is a company known for its integrity, dedication to service excellence, and stellar reputation. Click here to visit LRI's website.

President's "E" Award for Export Service in 2012 and the company's wide reach includes 12 offices throughout North America and locations in 102 countries. This is a company known for its integrity, dedication to service excellence, and stellar reputation. Click here to visit LRI's website.

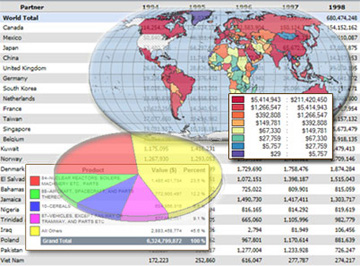

How does your State measure up?

Total merchandise exports from the U.S. in 2012 reached a record-setting value of $2.2 trillion!

The International Trade Administration's Office of Trade and Industry publishes individual fact sheets for all 50 states. See the fact sheet on your State here. An interactive map with national and state merchandise trade data is available here.

The International Trade Administration's Office of Trade and Industry publishes individual fact sheets for all 50 states. See the fact sheet on your State here. An interactive map with national and state merchandise trade data is available here.

Partner Spotlight: Northstar Trade Finance

Northstar Trade Finance has specialized for nearly 20 years in providing financing solutions to small- and medium-sized enterprises involved in cross-border capital equipment transactions.

Established in 1994, its partners include governmental Export Credit Agencies and Trade Credit Insurers in North America and Europe, including: Export Development Canada, U.S. Ex-Im Bank, UK Export Finance, Euler Hermes, and Coface, among others. Through its global network and representation in numerous foreign markets, Northstar offers multi-year financing in several major currencies. In addition to export sales of American- and Canadian-made equipment, Northstar offers financing of U.S. companies' exports from their overseas manufacturing facilities.

Established in 1994, its partners include governmental Export Credit Agencies and Trade Credit Insurers in North America and Europe, including: Export Development Canada, U.S. Ex-Im Bank, UK Export Finance, Euler Hermes, and Coface, among others. Through its global network and representation in numerous foreign markets, Northstar offers multi-year financing in several major currencies. In addition to export sales of American- and Canadian-made equipment, Northstar offers financing of U.S. companies' exports from their overseas manufacturing facilities.

TAG has enjoyed a strategic relationship with Northstar Trade Finance for more than 6 yrs. Since 2007, we have worked together to offer up to 5-year term financing for capital equipment exports ranging from $150,000 to $5 million. As Ex-Im Bank's most active medium-term Delegated Lender, Northstar offers fast-track application processing to well-qualified foreign buyers -- in weeks, not months. Northstar's relationship building approach matches our own which promotes mutual referrals and expands both of our capabilities in offering export financing solutions to our valued customers.

If you are interested in offering multi-year financing to your foreign customer and are searching for an institution to finance the sale, please contact us and we can determine if Northstar would be a good fit for your transaction.

Please visit www.northstartradefinance.com or contact TAG for more information.

Special Financing Options for Small Business Exporters

In early 2012, the U.S. Export-Import Bank (Ex-Im Bank) introduced a new program for small businesses called Global Credit Express (GCE). GCE provides small businesses access to additional borrowing capacity to finance various components of their export business, not just production. The application process is credit-score based for streamlined approval time. Upon approval, Ex-Im Bank lends directly to the small business exporter as opposed to providing its guarantee to the exporter's lender. The maximum loan amount is $500,000 with terms of 6 or 12 months.

Global Credit Express can only be accessed through an Ex-Im Bank-approved originating lender or originating broker such as TAG. We can quickly help you determine if GCE is an appropriate tool for your company and manage the application process for you.

For more information contact us or click here to read more about GCE (pdf).

As always, we value our relationship with you. If we can be of assistance in any way, please let us know.

Kind Regards,

The TAG Team

Curt, Leslie, Ursula, Jackie and Sara